As the artificial intelligence boom takes off, Nvidia Corp (NVDA.O) is expected to emerge as the biggest – though not the only – winner among chipmakers after years of focusing on the technology has made it a go-to supplier for tech firms.

AI has emerged as a bright spot for investments in the tech industry, whose slowing growth has led to widespread layoffs and a cutback on experimental bets.

The surge in interest helped Nvidia report better-than-expected quarterly earnings on Wednesday and its forecast sales above beat Wall Street expectations, in stark contrast to a projected loss and dividend cut from rival Intel Corp.

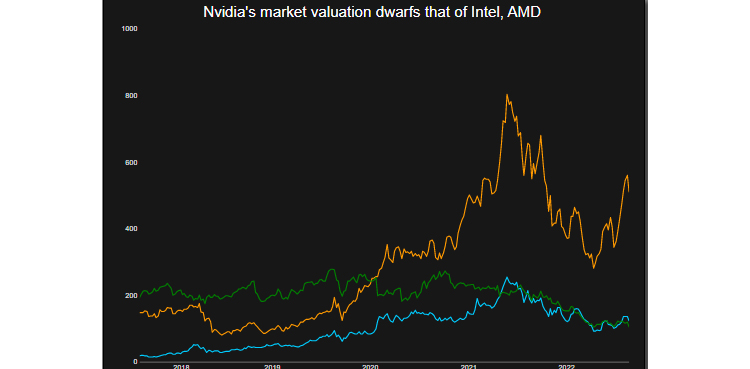

Nvidia shares rose nearly 14% to $236.70 on Thursday. They have jumped more than 60% since the turn of the year, nearly three times the gain in the Philadelphia Semiconductor Index (.SOX).

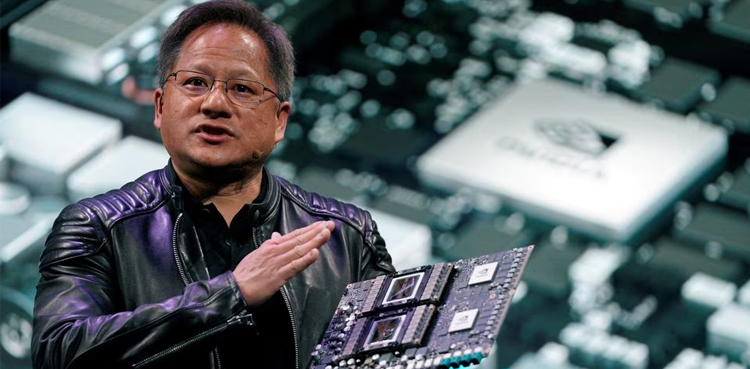

The company got its start in the graphics chip business for PCs by helping video games look more realistic, and then rode the cryptocurrency wave as its chips were used for mining. Now, the next push comes from generative AI.

Nvidia’s surge Thursday has boosted its market value by more than $70 billion. That brings it to more than $580 billion, about five times that of Intel. It is the seventh-largest publicly traded U.S. firm.

The key to the company’s success is that it controls about 80% of the market for graphic processing units (GPUs), which are specialized chips that provide the kind of computing power required for services such as Microsoft-backed (MSFT.O) OpenAI’s wildly popular ChatGPT chatbot.

from Science and Technology News - Latest science and technology news https://ift.tt/51jIPSz